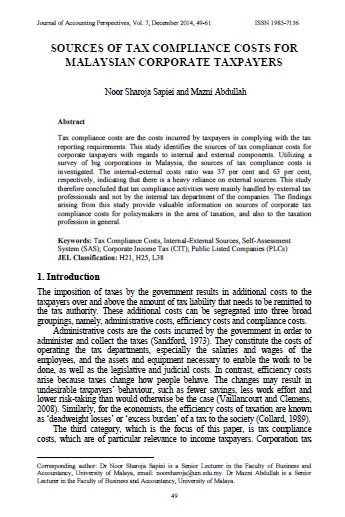

Sources of Tax Compliance Costs for Malaysian Corporate Taxpayers

DOI:

https://doi.org/10.22452/AJAP.vol7no1.4Keywords:

Tax Compliance Costs, Internal-External Sources, Self-Assessment System, Corporate Income Tax, Public Listed CompaniesAbstract

Tax compliance costs are the costs incurred by taxpayers in complying with the tax reporting requirements. This study identifies the sources of tax compliance costs for corporate taxpayers with regards to internal and external components. Utilizing a survey of big corporations in Malaysia, the sources of tax compliance costs is investigated. The internal-external costs ratio was 37 per cent and 63 per cent, respectively, indicating that there is a heavy reliance on external sources. This study therefore concluded that tax compliance activities were mainly handled by external tax professionals and not by the internal tax department of the companies. The findings arising from this study provide valuable information on sources of corporate tax compliance costs for policymakers in the area of taxation, and also to the taxation profession in general.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

License

The Asian Journal of Accounting Perspectives (AJAP) articles are published under a licence equivalent to the Creative Commons Attribution-NonCommercial-NoDerivs License (CC BY-NC-ND). The licence allows users to copy, distribute, and transmit an article as long as the author is attributed. The article is not used for commercial purposes. The work is not modified or adapted in any way.

Copyright

Authors are required to sign the Exclusive License to Publish agreement upon publication in the AJAP. The agreement grants the Publisher (Faculty of Business and Accountancy, Universiti Malaya) to publish and disseminate the articles.

Open Access

Articles published in the AJAP are digital, online, free of charge, and free of most copyright and licensing restrictions.

Article Processing Charge

Articles publish in AJAP is free submission, production and publication charges. However, all accepted articles are required for language editing. The AJAP officially appointed and outsourced proofreader will conduct this process, and the authors will cover the cost. AJAP does not profit from this process and transaction.