Tax Avoidance

The Scope and Effect of Section 140 of the Income Tax Act 1967

Keywords:

tax avoidance, tax evasion, Income Tax Act 1967, intention to deceive, bona fide, reducing liability to taxAbstract

There is an important distinction between tax evasion and tax avoidance. Tax evasion refers to all activities deliberately undertaken by a tax-payer to free himself from tax which the law charged upon his income, for example, the falsification of return, books and accounts or the suppression of some material facts. These schemes are illegal and are subject to very heavy and severe penalties. To constitute evasion there must be an intention to deceive.

Downloads

Download data is not yet available.

Downloads

Published

2019-01-12

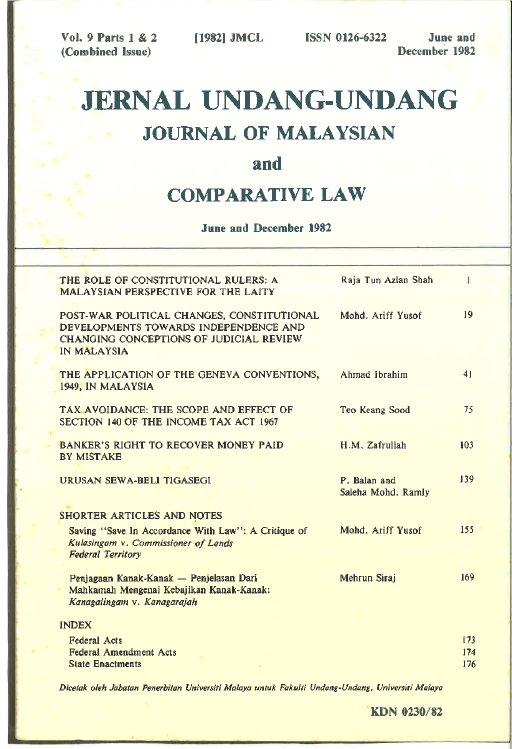

How to Cite

Teo, K. S. (2019). Tax Avoidance: The Scope and Effect of Section 140 of the Income Tax Act 1967. Journal of Malaysian and Comparative Law, 9(1 and 2), 75–102. Retrieved from https://ejournal.um.edu.my/index.php/JMCL/article/view/15892

Issue

Section

Articles